In Capital Gains Opportunity – The SLV Call Option, I mentioned that there is a huge opportunity in trading the stock options of SLV and how I did it.

I started trading the SLV stock options with only $430 in my brokerage account. Here’s what happened so far:

November 12, 2010:

The rightmost side of the chart shows a hammer formation. It is called such because the latest candlestick looks like a hammer. It is usually my experience that after a huge move upward in a chart, it will go down for a while and that the hammer formation is usually an indicator of that. Because of the fear that my trades will lose in value, I had no choice but to sell the two options I bought in Capital Gains Opportunity – The SLV Call Option.

November 18, 2010:

The good thing about SLV is that it tracks the price of silver in the international market and it is usually the case that silver is being traded around the world 24 hours on weekdays. With that I took a look at the 1-hour chart of Silver using the Netdania Chart of DailyFX.com.

I checked out the chart above a few hours before the opening of the stock market session in the US. The 1-hour chart above gave me an advantage because it provided me with a sneak-peek on what will happen on the SLV on the next few hours.

Here’s Daily Chart of the SLV on November 18:

The candlestick at the rightmost side of the chart is called a doji. If a doji was formed after a series of bullish candles (white candles that are going up), it is usually an indicator that there is a possible reversal on the chart movement (which means that there’s a chance that the chart will go down). But in this case where a doji was formed after a series of bearish candles (red candles that are going down), it is an indicator that there is a possibility that the next few candles will be bullish.

Using the doji formation in the Daily Chart and the “sneak peek” of the 1-hour silver chart, I came into conclusion of entering the market again thus I made these orders:

- Buy 1 contract of SLV Apr11 Call (Strike Price of $32)

- Buy 2 contracts of SLV Apr11 Call (Strike Price of $27)

November 26, 2010:

I sold my previous positions with the fear that the SLV chart will reverse. Account balance: $450.05

November 30, 2010:

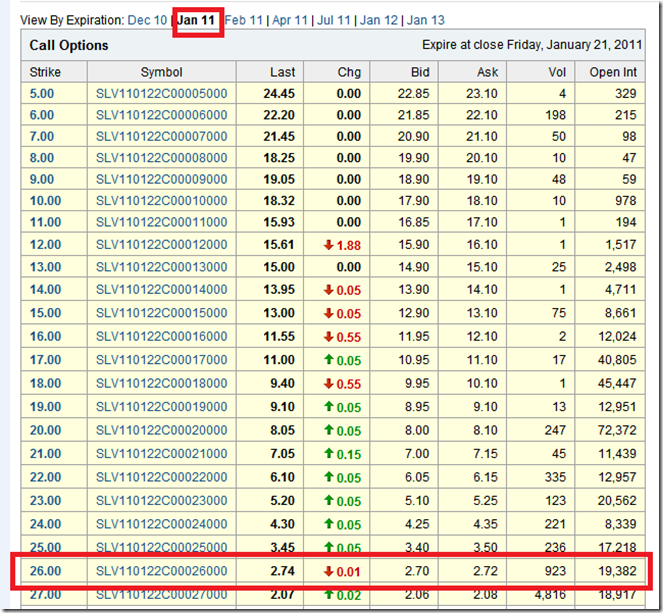

I entered the market again and bought the following thinking that the SLV chart will continue to go up:

- Buy 1 contract of SLV Feb11 Call (Strike Price of $30)

- Buy 1 contract of SLV Apr11 Call (Strike Price of $26)

December 8, 2010:

What I have been thinking these past few weeks finally came true. The chart reversed after silver hitting the $30 mark:

With the fear of losing my entire account and wanting to take the profits I made, I sold all my positions.

December 9, 2010:

I entered the market again with the intention that this time I will hold the position longer. In order to protect my account from sudden drops in the market I placed a Stop-Loss Order which basically tells the broker to automatically sell my position if the price drops and hit a certain point:

Here’s my account balance as of December 10, 2010:

Kicking myself in the butt:

The primary reason why I sold all my positions before buying again is I fear that the SLV chart will reverse and drastically go down. I should have instead placed Stop-Loss orders on the first SLV options I bought in early November.

Do you know what will happen to my account if I just held onto the first SLV options I bought?

My $430 initial account should be worth $755 right now if I hadn’t sold my first SLV options in the first place.

I didn’t realize at that time that I could just simply set Stop-Loss orders on my positions in order to protect my profits.

I am kicking myself in the butt now.

You are not welcome to join in the butt-kicking but you are welcome to laugh at my stupidity.

WARNING: Articles posted in this blog are from my actual life experiences and opinions. These do not guarantee a life of riches, alleviation of poverty, or making the world a better place. I am NOT LIABLE if you follow any of the articles posted in this blog and got poor.

INVEST AT YOUR OWN RISK. YOU ARE RESPONSIBLE FOR YOUR OWN DESTINY.